What does the PPP process mean?

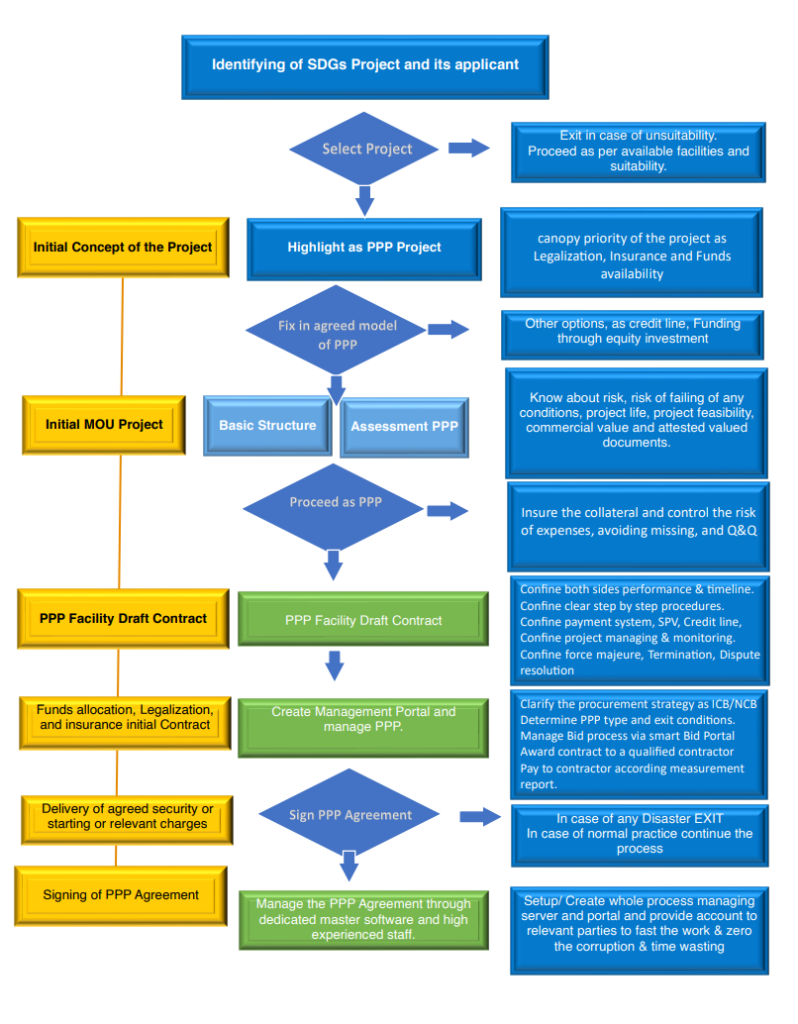

The PPP process involves determining the step -by- step administration, documentation, funding, and execution of the project according to the selected model of PPP.

Types of the PPP Process

Generally, the process is categorized into two systems: solicited and unsolicited processes . A solicited proposal is one that is submitted in response to a specific work statement from the sponsor. A Request for Proposals (RFP) or Request for Applications (RFA) is sometimes used by sponsors to solicit proposals for specific research, development, or training projects or to provide specific services or goods.

General Definition of Unsolicited

An unsolicited request is a request made by a customer of a retail establishment without any prompting from an owner, operator, employee, or agent of the retail establishment.

In PPP terms, an unsolicited proposal occurs when someone approaches a business or government with a proposal for the company to provide them with a service or product. Perhaps you are offering a trial or demonstration or asking them to be your guinea pigs to test your product’s or service’s efficacy. Alternatively, you may be seeking funding.

Non- Solicitation Letter

Non-solicitation, in contract law, refers to an agreement, typically between an employer and employee, that prohibits an employee from utilizing the company’s clients, customers, and contact lists for personal gain upon leaving the company. Generally, most facilitators, traders , and platforms require this type of letter from applicants or clients to protect the process from any risk, ensuring the safety of business resources and financial confidentiality.

The PPP process and procedures for each project depend on its model, but the general and well-known processes followed by most organizations are as follows .

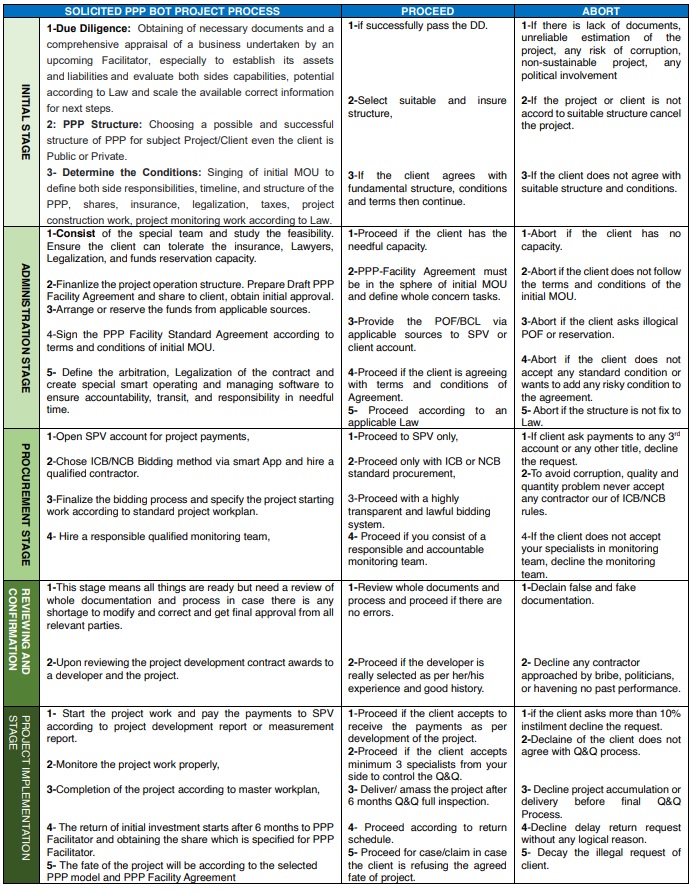

Solicited PPP BOT Project Process

“Unsolicited proposals warrant more disclosure as they pose a greater risk to value for money than procurements done through open, competitive and transparent processes,” Whitfield said. “This could include aggregate information about why proposals are declined, as well as more extensive information about proposals that have progressed beyond the preliminary and strategic assessment stages.”

Additionally, mechanisms separate the people who assess proposals and those who make recommendations to Cabinet. Whitfield says this separation is a key mechanism to protect impartiality in decision-making. He was also confident in DPC’s processes that ensure potential conflicts of interest are managed appropriately and transparently.

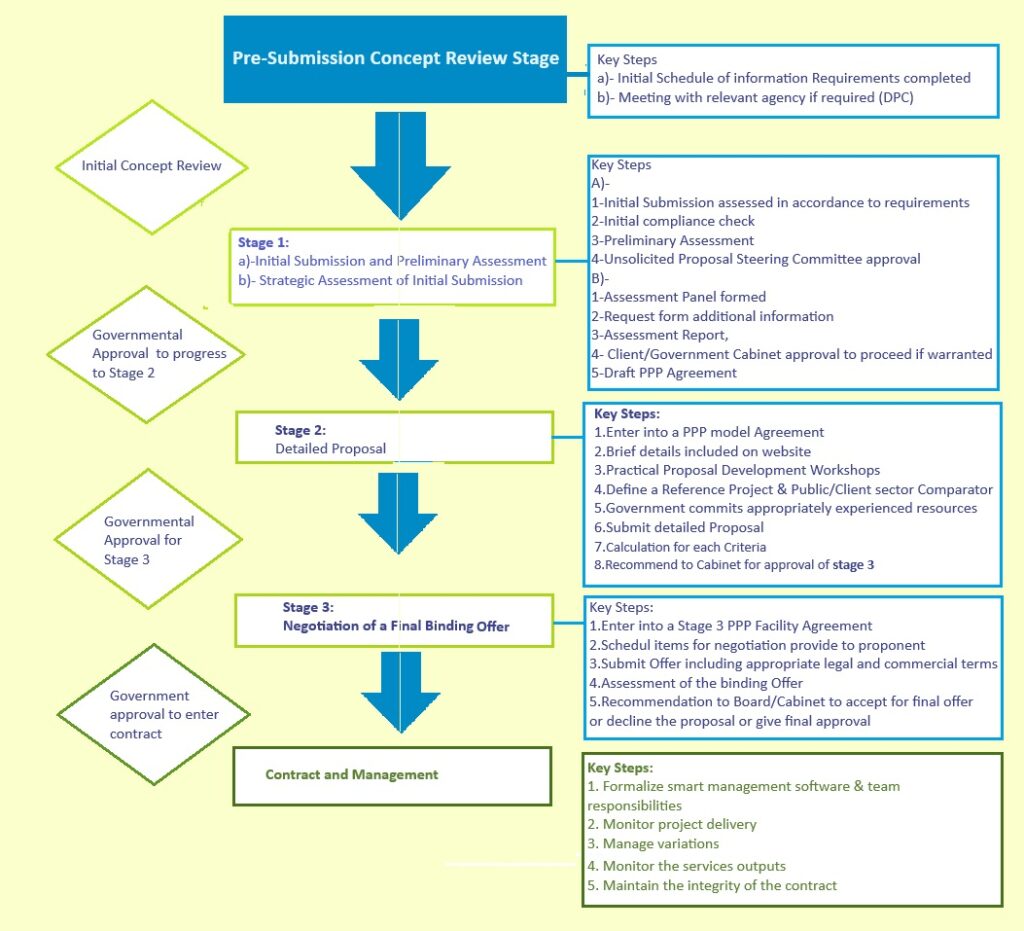

Pre-Submission Concept Review

Pre-Submission means a formal written request from an applicant/sponsor for feedback from FDA to be provided in the form of a formal written response or, if the manufacturer chooses a face-to-face meeting or teleconference with FDA in which the feedback is documented in meeting minutes.

UK guidance documents for its Private Finance Initiative

This outline is based on UK guidance documents for its Private Finance Initiative (PFI) programme. The experiences outlined on this website show that not all stages have been carried out in some PPPs, resulting in a high likelihood that the public authorities have failed to achieve good value for money.

Initial planning

The need for investments in a certain service sector needs to be critically assessed by the public authority to identify where improvements are needed and what project investments this will entail.

Outline Business Case

A ‘business plan’ needs to be prepared on behalf of the public authority, in which the project and procurement options are decided on. This should include assessments of:

-

- The affordability of the project.

- Which option offers best value for money: a ‘reference project’ is developed, which is the PPP option against which the future bids should be evaluated, and this should be compared with a publicly financed variant of the project, called the Public Sector Comparator, to see whether a PPP option or public option offers better value for money.

- What outputs are needed from the project.

- Which risks are involved in the project and which party should bear them.

- The timeline for the implementation.

- Whether there is likely to be sufficient interest from private companies in the project and whether there are a sufficient number of private companies with the relevant skills to ensure that real competition takes place.

- Service requirements and standards.

- The payment mechanism that would be appropriate.

- Proposals for the monitoring of the project.

Publication of tender notice

After the tender notice has been published, an information pack about the project and pre-qualification questionnaire may be distributed to companies that respond. The questionnaire is aimed at establishing whether the company has the technical and financial capacity to deliver the project.

Pre-qualification of bidders

From the pre-qualification questionnaire, a list of the pre-qualified bidders is made, with an explanation of the reasoning behind the decisions.

Shortlisting of bidders

If there are still several pre-qualified bidders, further shortlisting may take place aimed at identifying which bidders are most suitable to undertake the project.

Issue of Invitation to Tender/Negotiate (ITN) and receipt of bids,

The shortlisted bidders are sent the ITN, which is a more developed version of the information pack, including the output specification, payment mechanism (including performance standards) and model contract.

Evaluation of bids and best and final offers

After the bids submitted in response to the ITN, two bidders may be invited to submit a Best and Final Offer, or this stage may be omitted if the ITN bids allow the choice of a preferred bidder.

Approval of Final Business Case and preferred bidder

The preferred bidder is appointed, preferably along with a reserve bidder in case agreement cannot be reached with the preferred bidder. When the terms of the contract are more or less clear, a Final Business Case is prepared for approval by the relevant decision-makers.

Negotiations and contract award

The negotiations with the preferred bidder are not supposed to result in major changes to the project, yet in a number of cases this has happened, since the negotiations essentially take place under monopoly conditions. The signing of the contract is known as the commercial close of the project and should happen as close as possible to the financial close, the stage at which financing contracts are signed.

Project implementation

Payments to the company implementing the project typically begin after the construction phase has ended and the infrastructure is ready to use. The PPP may take the form of a concession, in which the project company is entitled to charge users directly for the duration of the contract (e.g. for a highway, where the company collects tolls directly from users) or a unitary fee, in which the public authority pays the project company an amount defined in the contract (e.g. for hospitals). The unitary fee may be fixed, as for schools and hospitals, or may depend on the number of users of the infrastructure (e.g., shadow tolls for highways).

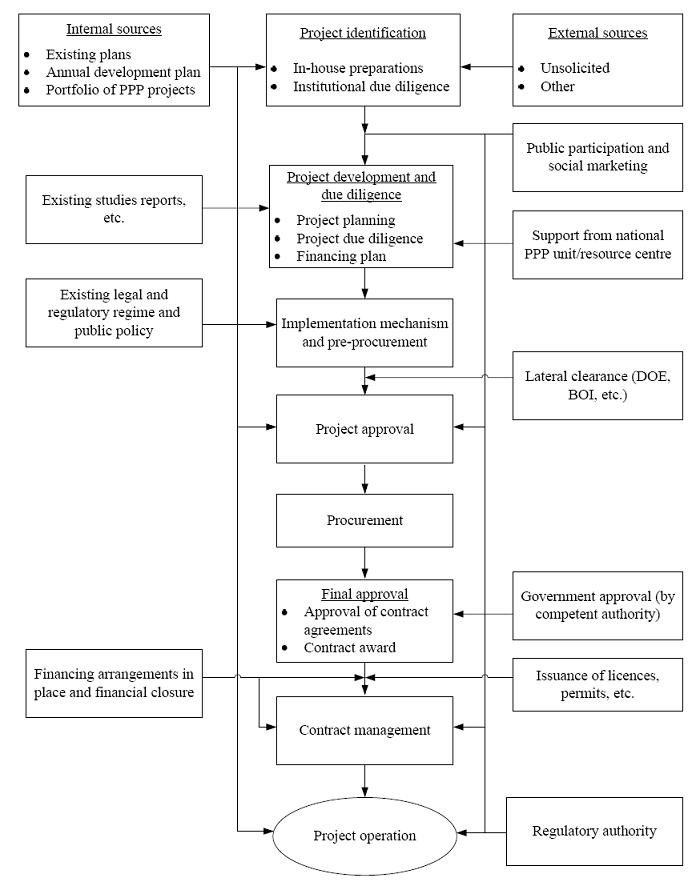

Economic and Social Commission for Asia and Pacific PPP project implementation process

The credit of below figure and pro is right of ESCAP. The figure below shows the steps that are generally considered in a PPP project implementation process. Clear definitions and procedures of various tasks and administrative approval from competent authorities at different stages of project implementation process are necessary in running a successful PPP programme. Streamlined administrative procedures reduce uncertainties at different stages of project development and approval and help to reduce the transaction cost of a PPP project.

Explanation

1. Identification of private sector/PPP projects

• Project identification

1B. In-house preparatory arrangements

• Conceptual project structure

• Institutional due diligence (legal and regulatory framework, government policy, involvement of other departments, in-house capacity, etc.)

• Project implementation strategy

• Setting of project committee(s)

1C. Government approval (e.g. by a special body established for PPPs)

1D. Appointment of transaction advisor (if needed)

• Terms of reference

• Appointment

Government approval

2. Project development and due diligence

• Project planning and feasibility

• Risk analysis

• Financing

• Value for money

• Business model

• Government support

• Service and output specifications

• Basic terms of contract

• Independent credit rating (when possible)

• Preliminary financing plan

Government approval (Special body, concerned ministries, central bank)

• Financing plan

3. Implementation arrangement and pre-procurement

• Implementation arrangement

• Bidding documents

• Draft contract

• Special issues (land acquisition, foreign exchange, investment promotion, etc.)

• Bid evaluation criteria, committees

Government approval (Special body, legal office, Ministry of Law)

4. Procurement

• Market sounding

• Pre-qualification of bidders

• RFP – finalization of service and output specifications

• Final tender

• Bid evaluation and selection

Government approval (Special body, cabinet, etc.)

5. Contract award and management

• Contract award, financial close and contract signing

• Service delivery management

• Contract compliance

• Relationship management

• Renegotiation (when needed)

Government approval of renegotiation terms (Special body, cabinet, etc.)

6. Dispute resolution

• Establishment of a process and a dispute resolution team

Government approval (when needed by defined bodies)

Note: above information belongs to ESCAP

General Procedures between two private entities for PPP Model.

| Step 1 |

1. Client submits project documents, LOI, BCL/BRL and CIS/KY for DD. 2. Upon successful DD, selection of suitable PPP model. 3. Upon agreeing on a structure, Defining the fundamental terms and condition in an MOU. 4. Upon signing of MOU, the applicant and Facilitators enters 2nd step. |

| Step 2 |

The applicant provides/deposit/ Place the agreed collateral, the Facilitator/Platform acts for following foremost actions, (a)- Preparing a detailed PPP Facility Agreement according to main MOU through Lawyers or standard PPP Facility Agreement. (b)-Projects insurance insuring (c)- PPP Faciality Agreement approval from Lawyers, (d)- PPP Faciality Agreement approval form facilitator financial sources. (e)- Project funding confirmation according to PPP Facility Agreement. 3. The applicant releases or provides agreed assets/credit to facilitator. |

| Step 3 |

Consist of the qualified team to manage the following essential process, a)- Completion designing, procurement, technical and managing documents of the project/ developing the smart managing project software. b)-Opening of SPV account. c)-Hiring the qualified developer contractor, d)- Consisting Of the monitoring, quality and quantity controlling team. |

| Step 4 | Starting of the payments to SPV account, Starting the project execution/ development Operate the project according to terms and conditions of Agreement. Share the ownership/profit according to agreed terms conditions. |

[/vc_column_text][/vc_column][/vc_row]